Living the dream starts with a plan.

Your finances look good today. But how will they look 10, 20, or 30 years into your retirement? You need a plan!

Even if you’ve been consistently saving according to a plan, you’ll need a new or significantly updated strategy as you approach and enter retirement.

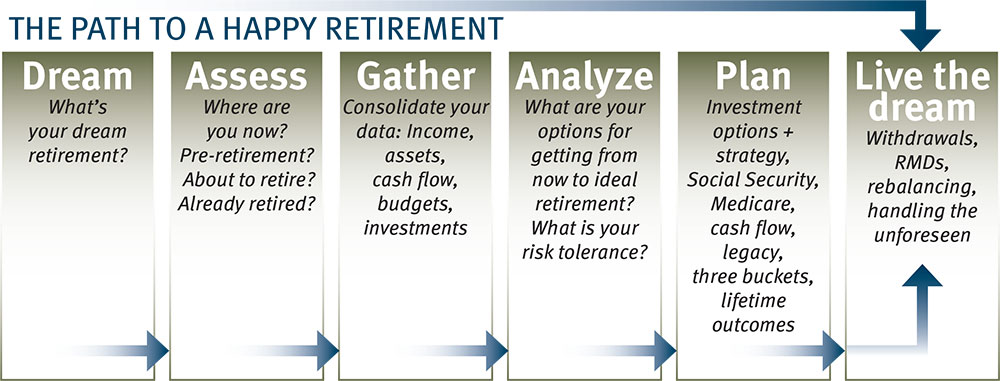

Step one is to realistically assess your situation. We’ll help you ask the right questions, starting with: What does your dream retirement look like? Will you travel? Spoil your grandchildren? Cruise the seven seas? Study something new? Grow a big garden? Golf five days a week?

It’s fun to dream! But to make your dreams come true, you have to consider practical questions, including:

- How much do you have saved?

- How old are you? How is your health?

- How long do you expect to live?

- What is your after-tax budget? What do you typically spend every month?

- Do you want to have a legacy to leave for your family or favorite charities?

We’ll help you answer the important questions.

Plan for everything.

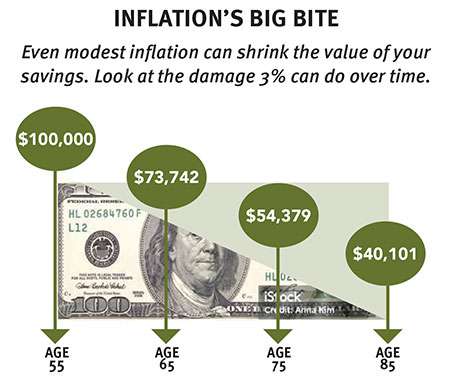

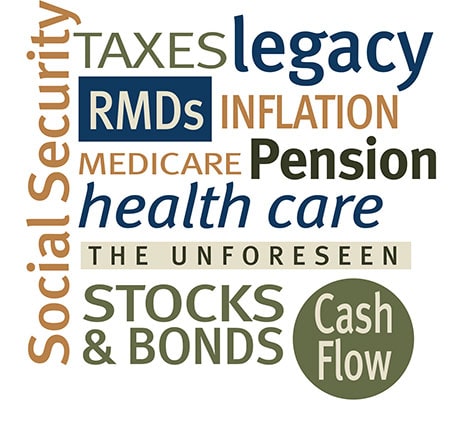

There’s a lot more to consider in your retirement plan than budget and savings. You need to make decisions about Social Security and Medicare. (Our independent Medicare advisor can help you with that.) And taxes and inflation are two items that could undermine your plan if not budgeted correctly.

Then there’s your investment portfolio itself. Your risk tolerance and investment strategy in your accumulation years will likely be different during your withdrawal years. Still, your investments need to keep growing so your money lasts for the rest of your life.

Retirement and Investment Group has the experience combined with sophisticated tools and models to create a plan with you that will support your ideal retirement and help you feel confident about your finances.

A dynamic guide to the rest of your life.

A well thought-out, data-driven plan shows you how your finances will unfold throughout your retirement. You can be confident in how you’re spending (or not spending) your money. And you’ll always have the data to make sound decisions. That kind of knowledge is priceless.

Your plan is a living document that keeps your goals always in sight. As your circumstances and priorities change, as they inevitably do — whether it’s welcoming new grandchildren, pursuing a new adventure, or dealing with an unforeseen health issue — we’ll help adapt and evolve your plan with you.

One of our most important guiding principles is this:

We won’t recommend anything we wouldn’t invest in ourselves.

Plan to always have enough money.

The most important thing you expect of us or any financial partner is to make sure you have enough money to live the way you want today, and to be confident you’ll always have the money you need tomorrow. We tailor proven strategies to the specific circumstances and desires of each investor. Based on your risk tolerance and goals, we use sophisticated tools to model different investment scenarios and plot them over the course of your full retirement. Our approach is conservative yet realistic. We don’t take the risk of chasing the highest returns, but we recognize that your money has to keep growing if it is going to support you for life.

Living the dream.

You did it! It’s time to get down to the business of enjoying your retirement. You have things to do, places to go, people to see. And you don’t have to worry about your money because Retirement & Investment Group has all the important details covered.

We’re your partner for life. Your money matters still require careful attention but in different ways. While you’re enjoying your retirement, Retirement & Investment Group takes care of these critical items:

- Distributions: Keeping the cash flowing to fuel your spending plan.

- Required minimum distributions: Making sure you meet the government’s RMDs every year, and utilizing those funds according to your plan.

- Taxes: Minimizing your tax liability for distributions; handling tax withholding.

- Qualified charitable distributions: Supporting your nonprofit causes while minimizing your tax liability.

- Ongoing investment management: Rebalancing your portfolio as necessary and keeping the appropriate funds in each of your three buckets.

…and whatever else is required to keep your plan on track and your financial house in order. We pride ourselves on taking care of every detail on your behalf. Throughout your retirement, our financial professionals are always just a phone call away for whatever help you need.

We never invest in anything that doesn’t have daily liquidity. And we never invest in anything that has upfront costs or backend charges.

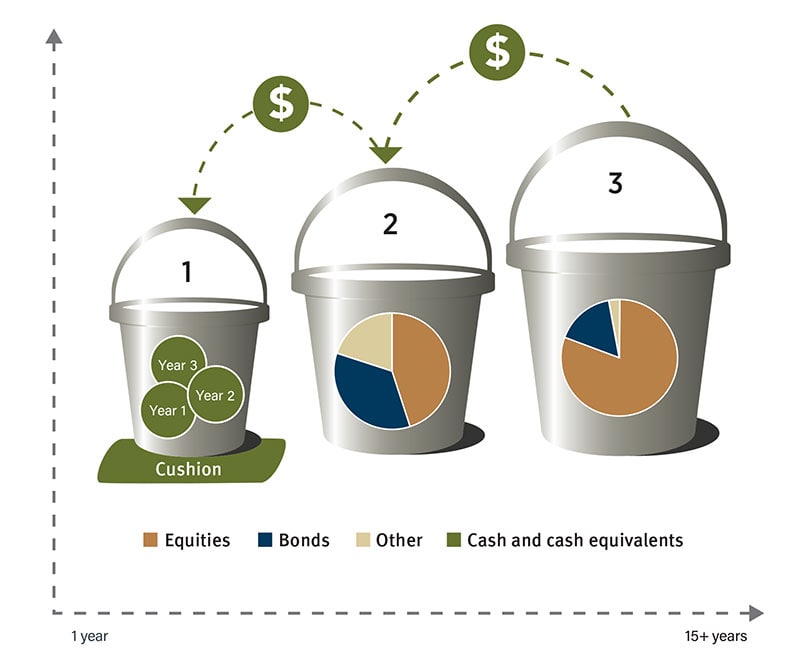

The Three-Bucket Strategy

Dynamically allocating your portfolio across a three-phase, risk-adjusted timeline gives you the confidence that you’ll always have the money you need. As investments grow in Bucket 3, some are moved into the more conservative Bucket 2, and monies from Bucket 2 are moved to Bucket 1 to support immediate spending. The funds keep flowing this way throughout retirement.

Bucket 1:

Super-safe reserve for the next one to three years, kept in cash and cash equivalents for current spending needs plus a cushion for emergencies.

Bucket 2:

Intermediate needs for the next 4 to 7 years. Lower-risk, reasonably safe investments to yield an inflation-countering return plus modest growth.

Bucket 3:

Long-term growth, years 8+. The most aggressive bucket in your portfolio, designed to achieve compounding growth that offsets inflation and withdrawals as well as real growth, ensuring you have adequate balances for your whole retirement.

No asset allocation strategy ensures a profit or protects against loss.